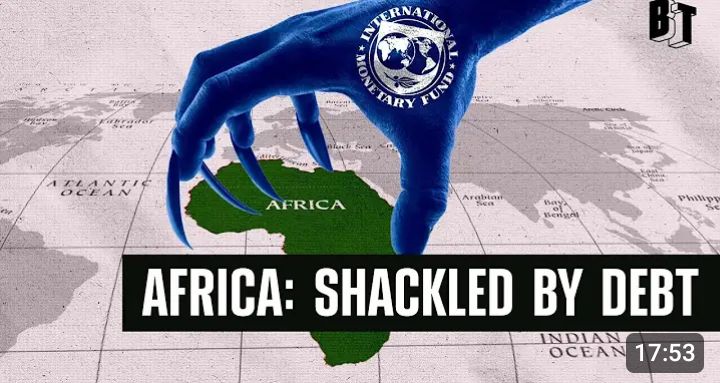

Life or Debt? How the IMF Keeps Africa Down

Notice: Test mode is enabled. While in test mode no live donations are processed.

Instead of helping promote development, the International Monetary Fund (IMF) traps countries in cycles of debt and instability. Grieve Chelwa, Director of Research, Institute on Race, Power & Political Economy at The New School, explains how countries of the Global South are forced to go to the IMF for aid over and over again.

The International Monetary Fund (IMF)’s lending practices and policy conditions has contributed to economic hardship and dependency in many African countries. While the IMF claims to support development and stability, its loans often come with strict conditions—such as austerity measures, privatization, and cuts to public spending—that can undermine health, education, and social protection.

This dynamic forces countries to choose between servicing debt or investing in their people—essentially a choice between life or debt. The result is often weakened economies, increased poverty, and reduced sovereignty, as governments prioritize repaying foreign creditors over meeting the basic needs of their populations.

We need to rethink global financial power structures, push for debt justice, and allow African nations to pursue development paths free from harmful external control.